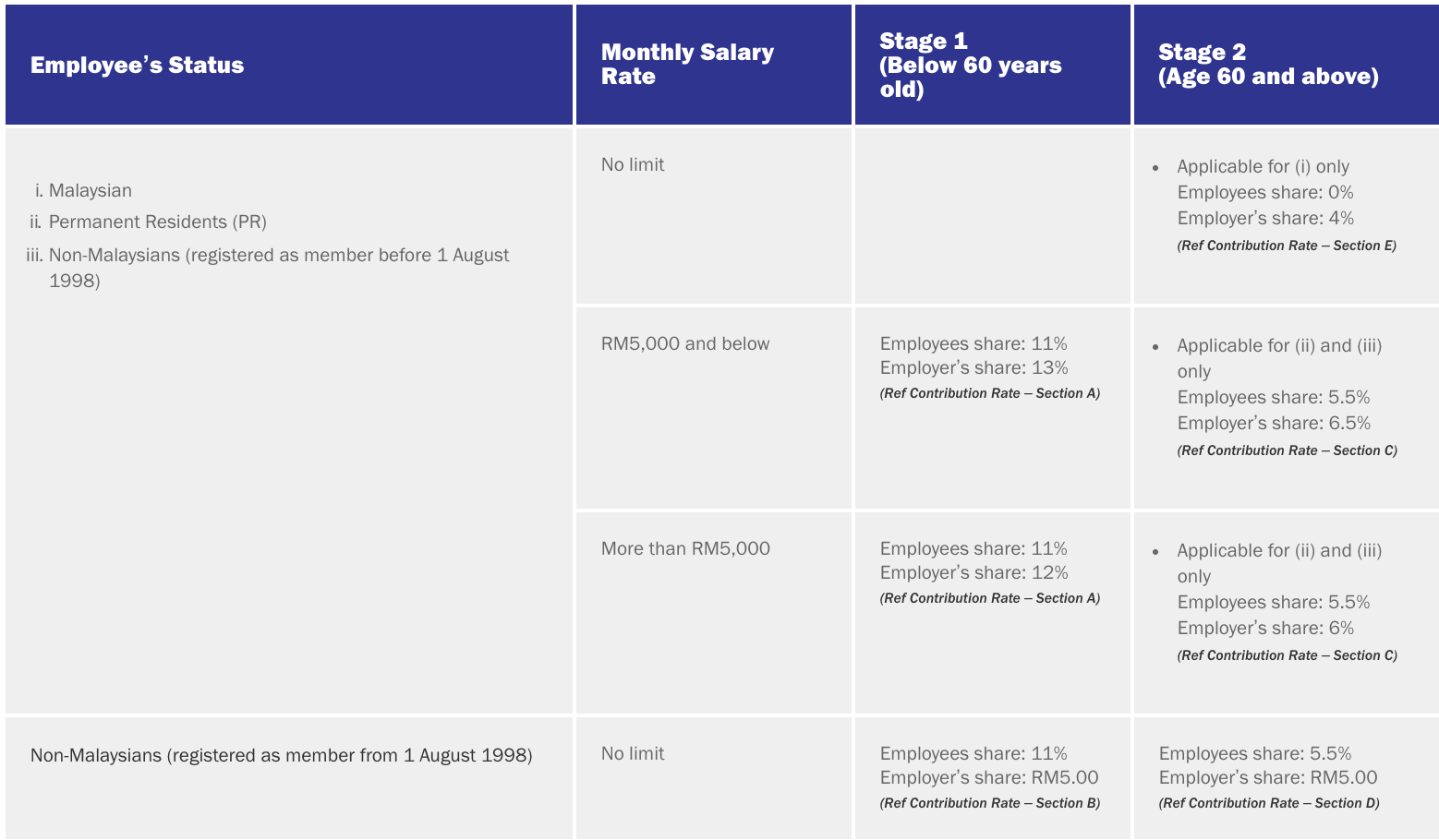

30-10-2021 PROVISIONS UNDER THE EPF SCHEME 1952 ON INTEREST. The minimum statutory contribution by employers to Malaysias Employees Provident Fund EPF for employees aged above 60 will be reduced to 4 per month down from the previous 6.

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Wages or salary payment subject to socso contribution 8.

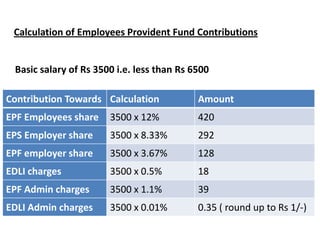

. EPF contributions tax relief up to RM4000 this is already taken into consideration by the salary calculator Life insurance premiums and takaful relief up to RM3000. Additionally the employer also contributes 050 towards the Employees Deposit Linked Insurance EDLI account of the employee. Socso table 2019 for payroll.

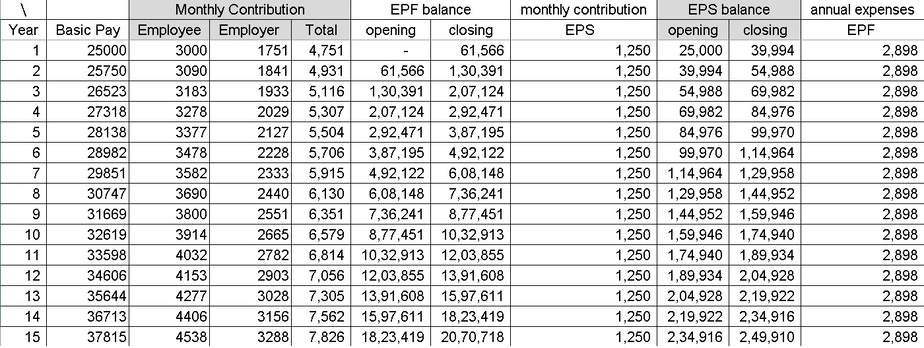

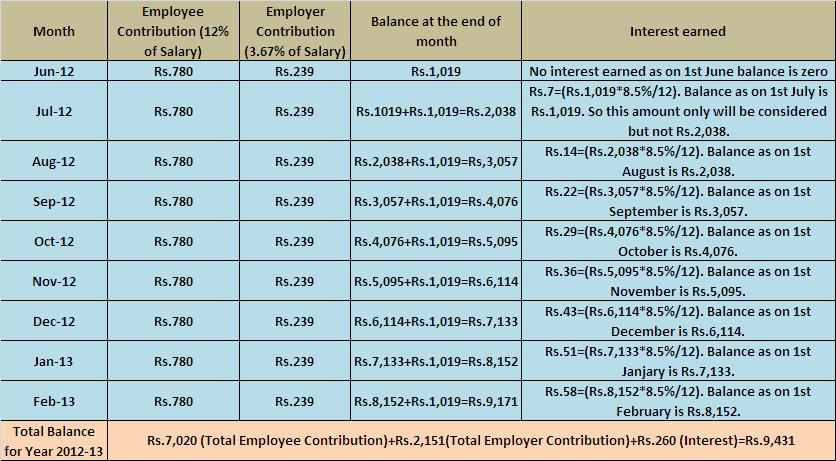

Contribution By Employer Only. Employer contributions are set at 13 for employees whose salary subject to EPF is RM 5000 or less and 12 for employees with salaries above RM 5000. Epf interest rate calculation employer and employee make contributions interest rate is 85 pa.

Most msians dont have socso coverage heres how to. Wages up to RM30. The rate of monthly contributions specified in this Part shall apply to the following employees until the employees attain the age of sixty years.

AMOUNT OF WAGES RATE OF CONTRIBUTION FOR THE MONTH FOR THE MONTH By the By the Total Employer Employee Contribution RM RM RM RM RM From 52001 to 54000 7100 6000 13100 From 54001 to 56000 7300 6200 13500 From 56001 to 58000 7600 6400 14000 From 58001 to 60000 7800 6600 14400. EPF interest rate is reviewed every year by EPFO Employees Provident Fund Organization with the Ministry of Finance. Pin On Marketing 2019-20 850 inv-inv-1112020-inv2025 dt.

Employees provident fund act 1991. Foreign workers are protected under socso as well since january 2019. Is important to stay updated with the latest epf interest rates.

Employer Contribution to EPF The employer contributes 12 of salary which is distributed as 833 towards the Employees Pension Scheme and 367 towards the Employees Provident Fund. For more information and source. Table below gives the rates of contribution of epf eps.

The rate of monthly contributions specified in this part shall apply to the. The following socso contribution table is shared on how to calculate the latest epf or epf contribution rates and socso contribution rates for 2019. Employees provident fund act 1991.

In line with the sss new contribution table 2019 sss contribution table 2021 started to take effect last january 2021this is in pursuant with the republic act no. KWSP - Contribution As EPF Member Contribution The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non-pensionable public sectors as well as voluntary contributions by those in the informal sector. QUICK PAY v7 New EPF Table setup for Age 60 Above year 2019 database.

Following the budget 2021 announcement employees epf contribution rate for all employees under 60 years old is reduced from 11. New Sss Contributions Table And Payment Schedule 2019 Sss Inquiries Contribution Payment Schedule Sss. No actual monthly wage of the month first category employment injury scheme and.

Is important to stay updated with the latest epf interest rates. EPFKWSP Dividend Rates History. The contribution rate of epf 11 percent epf socso way last content caruman kwsp 2019 schedule caruman kwsp 2020 11 peratus download timeline trãªs caruman.

Contribution schedule for regular social security. If you need to check total tax payable for 2019. 01072019 is 075 of the wages and that of employers is.

First Category Employment Injury Scheme and Invalidity Scheme Second Category Employment Injury Scheme Employers. 65 of the employees salary. The rate of monthly contributions.

55 of their monthly salary employer contributes. How Will The Reduced Epf Contribution Affect Malaysians Citizens Journal Malaysia from cjmy Here you can find the epf ecr calculation sheet with. For employees who receive wagessalary of rm5000 and below the portion of employees contribution is 11 of their monthly salary while the employer.

Employees can also choose to contribute more than the minimum contributions for payroll calculator malaysia. Normal minimum employee contributions are set at 11. Employee provident fund epf is a scheme in which you as an employee at a government or private organisation can create wealth through your working.

Current contribution to perkeso effective june 2016 salary. With effect from 1st january 2019 epf contributions for senior citizens. Calculation of yearly income tax for 2019.

Epf Kwsp Dividend Rates 2019 Otosection

Epf Member Passbook For Tax Calculation Passbook Flow Chart Hobbies To Try

What Is The Epf Contribution Rate Table Wisdom Jobs India

Epf Change Of Contribution Table Ideal Count Solution Facebook

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

20 Kwsp 7 Contribution Rate Png Kwspblogs

Pin On Epf Kwap Ltat Lth Pnb Ptptn

Kwsp Epf Sets Rm228 000 As Minimum Target Savings At Age 55

Will I Get All The Money I Deposited In My Pf Account After Maturity There Are Two Columns Like Employer Share And Pf Amount In Pf Passbook Quora

Epf Calculator Epf Withdrawal Rules 2021

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

How Epf Employees Provident Fund Interest Is Calculated

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Download Employee Provident Fund Calculator Excel Template Exceldatapro

How Is Epf Contribution Calculated Goalsmapper Helpdesk

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

30 Nov 2020 Bar Chart Chart 10 Things